In managing the company's payroll system, sometimes there are several employees who work part time or half time. This of course requires special attention in calculating their salaries. For companies, this can be a challenge in itself because they have to manage payroll efficiently and accurately. Therefore, this article will discuss some tips and tricks for managing the payroll system for companies that have employees working part time or half time.

Create a Clear Work Schedule

source : freepik

The first tip in managing a payroll system for companies with part-time or part-time employees is to create a clear work schedule. A clear work schedule will help avoid confusion in determining employee salaries. Make sure the work schedule is given to employees in writing so that employees can understand their work schedule well. In compiling work schedules, companies must pay attention to employee working hours, the shifts given, and the days off they get.

Determine Employee Wages

source : freepik

The next tip is to determine the wages of part-time or half-time employees correctly. Fair wages and in accordance with the hours worked will be a motivation for employees to work well. Also make sure that the salary of the employee is in accordance with the level of ability and experience of the employee. In determining wages, companies must pay attention to applicable wage policies and adjust them to industry standards.

Calculate Total Hours Worked

source : freepik

To calculate the number of hours worked by part-time or part-time employees, companies must use an accurate system. An accurate system will help companies avoid mistakes in calculating employee wages. Make sure that the company has an adequate attendance system to accurately record the number of hours worked by employees. In calculating working hours, companies must also pay attention to overtime and shifts given to employees.

I NEED PAYROLL APP

Calculation of Taxes and Deductions

source : freepik

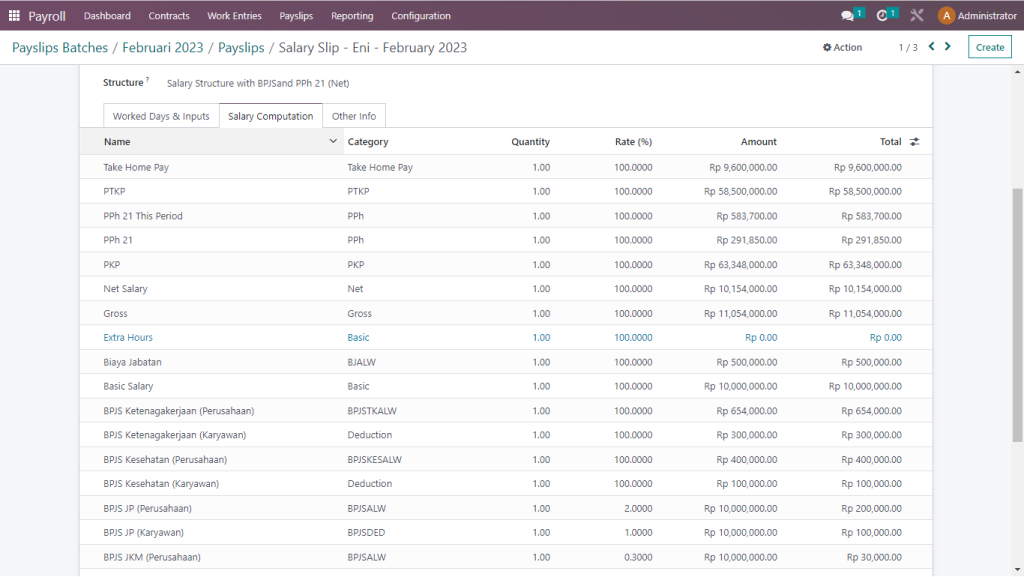

Companies must calculate taxes and deductions according to the amount of employee wages. Make sure that the calculation of taxes and deductions is done correctly and in accordance with applicable regulations. Companies must understand the types of taxes imposed on employee wages and adjust them to the amount of employee wages. In addition, companies must also pay attention to applicable deductions such as insurance deductions, BPJS deductions, and other deductions.

Use Payroll Software

Using payroll software such as Odoo can help companies manage employee payroll more efficiently and accurately. Odoo is an open source payroll software that can be used by companies with part-time or part-time employees. This software allows companies to easily enter employee data, manage attendance, calculate salaries, and generate reports.

In using payroll software, companies must choose software that suits their needs. Make sure that the software can meet the company's needs in managing the payroll of employees with part-time or half-time work. Companies must also pay attention to employee data security when using payroll software.

Create a Payroll System that is Transparent

source : freepik

The final tip for managing a payroll system for companies with part-time or part-time employees is to create a payroll system that is transparent. A transparent system will help companies ensure that employees receive salaries according to the number of hours worked and wages that have been determined. In creating a transparent system, companies must pay attention to several things such as establishing clear payroll policies, giving access to employees to check their payroll data, and making transparent payroll reports.

In managing the payroll system, companies must pay attention to several things such as work schedules, employee wages, number of hours worked, calculation of taxes and deductions, use of payroll software, and a transparent payroll system. These things will help companies manage the payroll of part-time or part-time employees more efficiently and accurately.

More important articles for your business

Single-Scale Payroll from the Company's and Employee's Perspective How to Calculate Salary with a Single Scale Payroll System Strategies for Success in Recruiting Generation Z Employees Why the Omnibus Law Sparked Controversy in Indonesia

In conclusion, managing the payroll system for companies with part-time or part-time employees does require special attention. However, by implementing some of the tips and tricks discussed above, companies can manage the payroll of part-time or part-time employees more easily, efficiently, and accurately. Companies can also use payroll software such as Odoo to facilitate employee payroll management. Thus, companies can ensure that their employees receive salaries according to the number of working hours and wages that have been determined and avoid salary calculation errors that can disrupt work relations.

Get the latest information about business management, human resources and technology by always visiting panemu.com/blog. To implement the Odoo payroll application, you can do it easily, by simply clicking the button below: